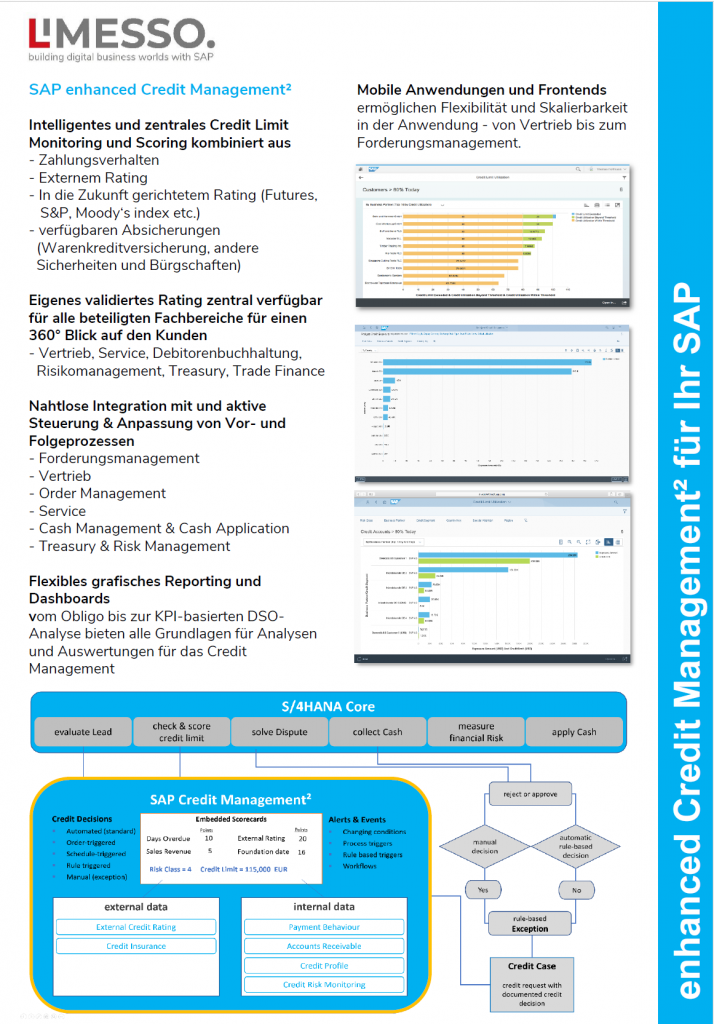

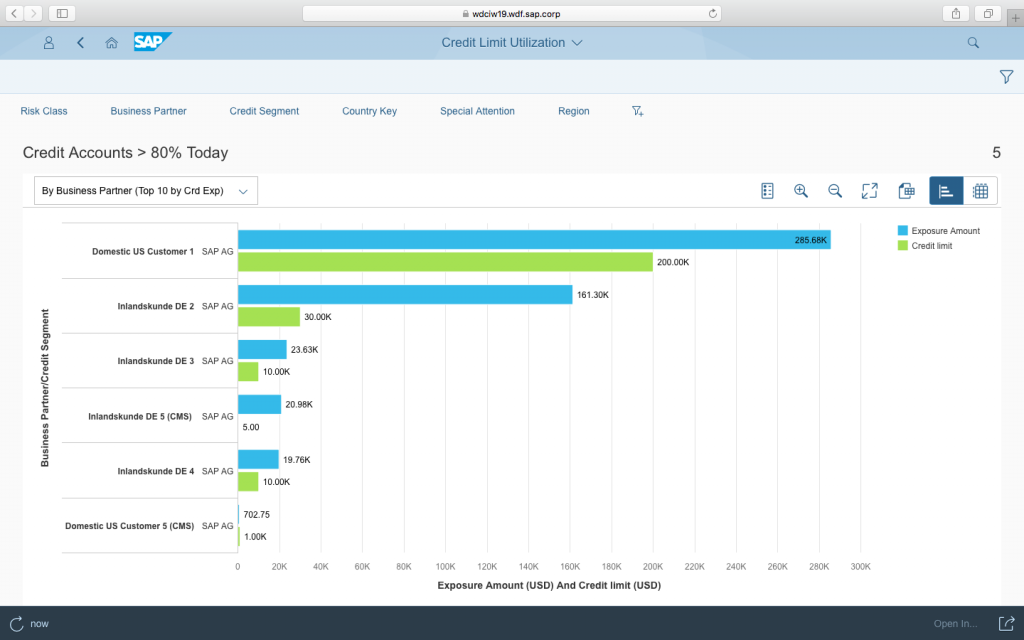

central management and monitoring of credit limits and risks

SAP® Credit Management offers companies and global organizations central management and monitoring of credit limits and risks. Integrating credit management functions into key transaction processes helps ensure company credit policies are enforced.

Automatic processes, intelligent release of credit limits

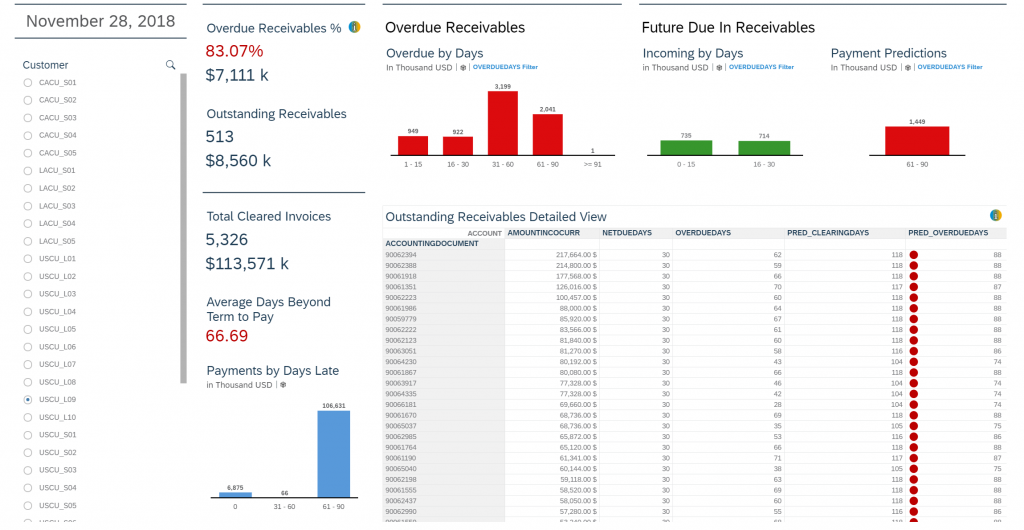

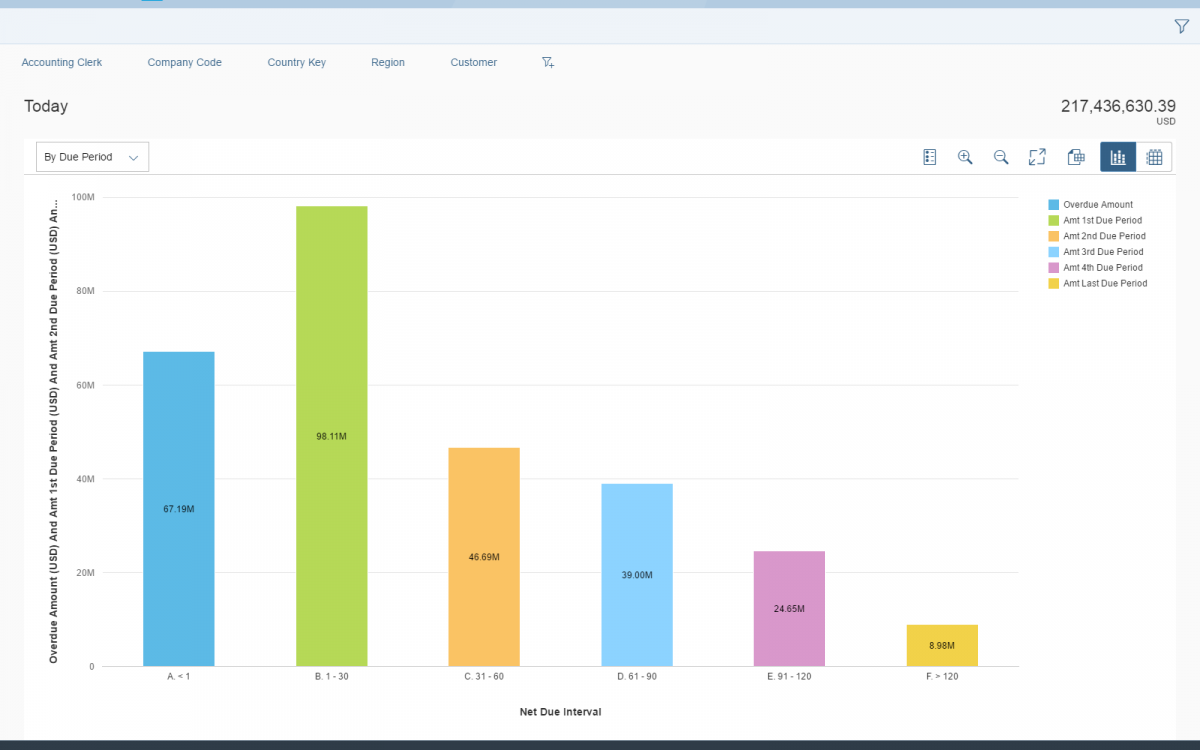

Automated credit limit assessment and approval processes accelerate turnaround time, minimize time and effort, and reduce blocked orders. Using a combination of internal data such as payment history and data from external sources enables analytics that help companies quickly adapt to changing market conditions. The result is a proactive credit management process to assess credit before confirming pricing and sales.

Active scoring based on intelligent rules

Automatic evaluation of customers based on sophisticated rules and intelligence. Not only payment behavior, but also future-oriented assessments and ratings (Standard & Poor's) and forecast models give you a comprehensive view of future developments and risk assessments.

Integration of trade credit insurance

Information such as contract data for trade credit insurance and its management is part of our extensions for SAP Credit Management. The amount of trade credit insurance is automatically adjusted to the customer's rating at the time of the assessment. Obligations such as non-payment reporting are part of the automatic functions in extended SAP Credit Management. Federal protection for foreign trade is also part of the solution.

Active sales support through integration and interaction

Provide your sales department with information on business development with the customer and access to all customer data! The integration of SAP CRM and Customer Management, but also Salesforce or other CRM systems, is part of the possibilities of the SAP standard.

Automatically & proactively adapted receivables management

SAP Credit Management is fully integrated with downstream receivables management. The proactive information and automatic adjustment of contact, clarification processes and communication channels, offer of partial payments or other financing instruments are automatic and rule-based. Your accounts receivable, receivables management, sales and credit management grow together and share information and processes interactively and proactively and finally become an “end-to-end” value chain.

Active credit eventing

Any change related to the customer triggers automatic checks and the update of all ratings and scoring. There is no information you miss with Enhanced Credit Management.

Integration of treasury or credit risk management and trade finance

The integration of Treasury and Risk Management with the Transaction Manager and the integration of trade financing are part of our solution and offer you an integration based on the SAP standard that add-ons cannot offer.

Robotic Process Automation Integration

Our solution - like credit management in the SAP standard - can be expanded and adapted with robotic process automation.

Paired with credit eventing, processes and workflows are triggered automatically and standard procedures are initiated.

Credit managers can concentrate on the specifics of their everyday business and do not have to deal with recurring processes.

en

en  de

de